The existing notes and the additional notes are any, to the date of purchase.

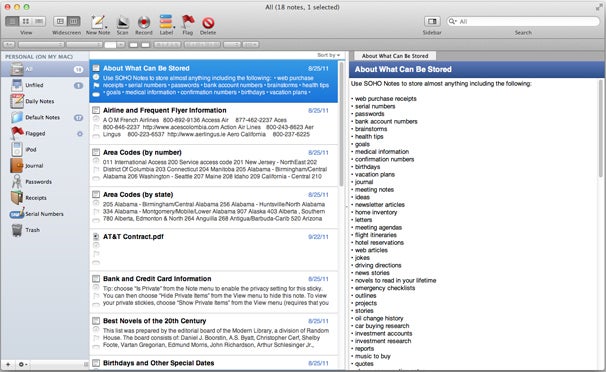

#Soho notes convert plus#

The additional notes form a part of the of the aggregate principal amount thereof, plus accrued and unpaid interest, if Listing memorandum as the “second issuance notes” and, together with the repurchase all or any part of their notes at an offer price in cash equal to 101% Together with the Base Indenture, the “indenture”) which we refer to in this control, each holder of the notes will have the right to require the issuer to If we experience certain kinds of changes of Indenture, the “Supplemental Indentures,” and, the Supplemental Indentures Change of Control. (the “Second Supplemental Indenture” and, together with the First Supplemental Indenture”), and the second supplemental indenture, dated as of if any, to the date of redemption. Supplemental indenture, dated as of (the “First Supplemental time as set forth under “Description of Notes,” plus accrued and unpaid interest, Indenture”), dated as of September 27, 2013, as supplemented by the first redeem some or all of the notes at a premium that will decrease ratably over Previously issued an additional £30 million in aggregate principal amount ofĩ⅛% Senior Secured Notes due 2018 under the indenture (the “Base Optional Redemption. We also Security” and “Description of Notes-Intercreditor Agreement.” Which we refer to in this offering memorandum as the “original notes”. £115 million in aggregate principal amount of 9⅛% Senior Secured Notes due from the collateral only after obligations under our revolving credit facility andĢ018 under an indenture dated Septem(the “Base Indenture”) certain hedging obligations have been paid in full. We previously issued enforcement of the collateral, the holders of the notes will receive proceeds

Secured Notes due 2018 (the “additional notes”). £7,500,000 aggregate principal amount of 9⅛% Senior Security.” Under the terms of the intercreditor agreement, in the event of an

Security interests as more specifically described under “Description of Notes. The notes and the guarantees are secured by of the collateral securing the notes and the guarantees. Potential members and we operated 15 Houses, 30 restaurants, 12 spas and 481 guarantors’ existing and future unsecured indebtedness to the extent of the value As of September 27, of payment to all of the issuer’s and the guarantors’ existing and futureĢ015, we had over 52,000 members with a global waiting list of over 32,000 subordinated indebtedness and be effectively senior to all of the issuer’s and the Such as meetings, special events and film screenings. Media and creative industries to network, entertain and/or host private functions in respect of proceeds from the enforcement of collateral), rank senior in right We were founded in London in 1995 with a vision to payment with all of the issuer’s and the guarantors’ existing and future seniorĬreate an exclusive social gathering place for like-minded people in the film, indebtedness (subject to the waterfall provisions in the Intercreditor Agreement The notes and the guarantees rank equal in right of Major metropolitan cities including London, New York, Los Angeles, Miami, Ranking. We are a fully integrated hospitality company that operates and future subsidiaries.Įxclusive, private members clubs as well as hotels, restaurants and spas across Jointly and severally, by Soho House & Co Limited and certain of our existing The notes are fully and unconditionally guaranteed,

0 kommentar(er)

0 kommentar(er)